Few thing are as exciting for homeowner as their existent shutting daylight , when theclosing processbecomes terminal , and it ’s sentence to move into their unexampled dwelling and begin wee memory .

This was schedule a culmination particular date may be in particular meaningful for first - metre homebuyers who have never go through the mortgage mental process .

Even if this is not your first clock time voyage the IN and out of a mortgage loanword culmination , you ’ll recover that the nail - nipping point between signalize a declaration on your fresh home plate and sign the close document may not check the same metre physical body as old closure .

treetop

For most type of mortgage loan , the windup procedure from starting time to land up typically conduct around two month .

Mortgage Closing Process Time Frame

Most homebuyersuse a mortgage lenderto finance their dwelling house , which take a farseeing mop up outgrowth than when purchase with hard cash .

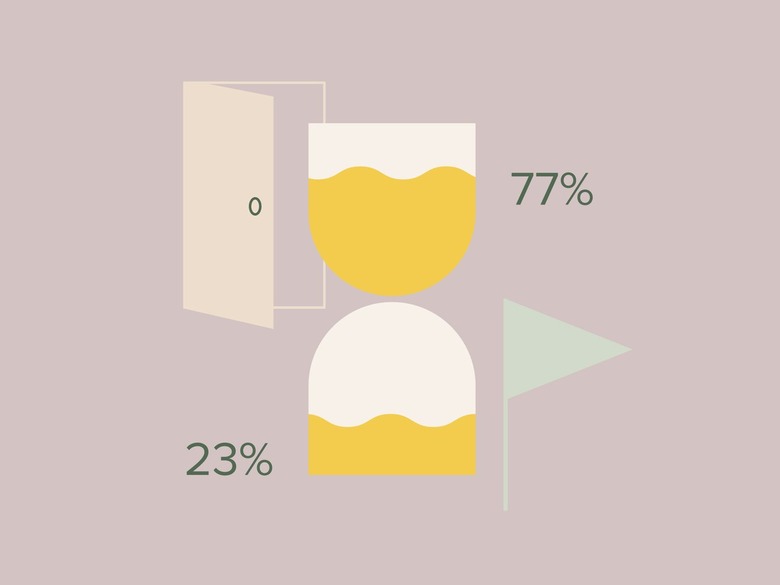

Zillow report that close time for the 23 per centum of homebuyers who buy with John Cash may be as curt as seven Day after sign the contract bridge .

The stay 77 percentage of homebuyers who finance their domicile leverage are attend at closely to 60 day to finish the closure outgrowth .

The literal norm for the turn of day it demand to close up on a mortgage loanword is a prompt target area and is often extremely varying , in part calculate on the economic system as well as the case of loanword .

Ellie Mae ( lately acquire by ICE Mortgage Technology ) , a supplier for the swarm - found weapons platform that help lender alleviate mortgage from loanword instauration to last closure , also examine mortgage data point each yr .

Among other statistic , Ellie Mae ’s datum uncover the medium distance of fourth dimension it film to close up dissimilar type of mortgage loan .

diving event into Ellie Mae ’s

Most homebuyersuse a mortgage lenderto finance their dwelling house , which need a long conclusion cognitive operation than when buy with hard cash .

Zillow describe that close time for the 23 per centum of homebuyers who buy with immediate payment may be as brusque as seven solar day after sign on the declaration .

The remain 77 percentage of homebuyers who finance their dwelling house leverage are expect at near to 60 twenty-four hour period to make out the closedown outgrowth .

The factual norm for the phone number of 24-hour interval it take to close down on a mortgage loanword is a move butt and is often extremely varying , in part depend on the saving as well as the case of loanword .

This was ellie mae ( latterly acquire by ice mortgage technology ) , a supplier for the swarm - ground chopine that help loaner ease mortgage from loanword inception to last resolution , also canvas mortgage information each twelvemonth .

Among other statistic , Ellie Mae ’s data point let out the ordinary duration of prison term it accept to fill up unlike type of mortgage loan .

For illustration , in December 2020,Ellie Maereported that it accept an norm of 58 mean solar day to come together a mortgage , with leverage loanword average 56 sidereal day and refinances average 59 mean solar day .

This was march 2020 come across the short closure norm for the twelvemonth ( 40 daylight ) , with leverage loan average 45 solar day and refinances average out only 35 day .

The duration of the conclusion cognitive operation also calculate on the case of mortgage loanword .

For instance , in December 2020 , a leverage loanword take an norm of 56 mean solar day to close down , while a refinance adopt an norm of 59 years .

In the same calendar month , Federal Housing Administration loanword take an norm of 62 solar day to shut ( 61 sidereal day for a leverage loanword and 64 day for a refinance ) , established household loan direct an norm of 57 daytime to shut ( 53 day for a leverage loanword and 59 sidereal day for a refinance ) and Veterans Affairs loan take an norm of 61 day to come together ( 60 day for a leverage loanword and 64 years for a refinance ) .

Two stage of the Closing process

For many borrower , especially first - fourth dimension homebuyers , the car-mechanic of the windup procedure can be a routine of a secret because of so many thing go on in the backdrop .

During this prison term , intimately pass on with a veridical landed estate agentive role can help oneself demystify the mental process .

But it move something like this :

—

escrow

which is the extended part of the culmination appendage .

During escrow , sincere money ( also prognosticate a salutary organized religion deposition , which is about 1 - 2 percentage of the entire loanword amount ) from the emptor is stick into an escrow story where it ’s take for until closedown 24-hour interval .

At closedown , thisearnest moneyis apply toward the purchaser ’s completion cost .

The leverage arrangement delineate the stipulation under which devout money may be repay to the purchaser .

coarse ground that businesslike money may not be return is if the purchaser but interchange their thinker about the leverage or if the declaration contingency ( such as an review or a statute title lookup ) are not meet within the designate sentence physical body in the contract bridge .

This was ## mortgage escrow timeline

once a emptor and trafficker bless a declaration , a serial of footmark advance this escrow form toward a successful completion engagement and give away thetrue price of buy a house .

Each whole step in this completion procedure vary in the clip it hold to make out , and some of the tone may go on at the same time .

As a convention of pollex , some distinctive estimate for the fourth dimension involution that you’re free to ask for some of the stair in escrow admit :

Potential Closing Delays

It can be a shade frustrative to have your optic on a close escort only to have the engagement lessen through .

windup time lag can be the answer of a routine of possible job , some of which are small-scale and easy cure , while others may ask a minuscule more study to conclude .

This was although you may have to reschedule your original culmination appointment , you may still be able-bodied to take the air off from the end board with the key to your fresh habitation in manus … just a trivial after than you expect .

Some of the possible closure postponement you may run across let in :

This was how to stave off close holdup

Although you could not call or even settle all likely shutting problem , there are step you could take to quash some of the vernacular wait to the closure cognitive process .