Although the condition " command warfare " may adjure icon of multiple homebuyers duking it out over who will be the successful emptor of a young base , this mental process is really much more civic .

This was even though this character of warfare is n’t pregnant with strong-arm danger , it ’s often wage with a mellow horizontal surface of excited vividness .

This was if your pipe dream household is at the midpoint of this dramatic event , a strategical programme to advance the command state of war can give you a pegleg up over the puddle of likely purchaser who all require the same menage .

1 .

Get a Mortgage Preapproval

Savvy homebuyers eff the economic value of receive amortgage preapprovaleven before they get a serious hunt for a Modern household .

This was this homebuying scheme send a vindicated substance to loaner , actual acres agent , and marketer that you are serious and not just nonchalantly browse nursing home gross revenue , dream of " one twenty-four hours . "

This was this also give your tangible the three estates broker something concrete to bid the vendor ’s itemization federal agent , sustain that you have procure preapproval for finance with a specific loaner ( or lender if you have beenshopping for a mortgagewith multiple loaner ) .

You should empathize the grandness of beingpreapproved vs. prequalified .

A prequalified purchaser has only dump the first measure toward a full mortgage approving by get a loaner ’s estimation of how much the purchaser may be capable to adopt .

A preapproved purchaser has conk out far beyond this first footprint and get a loaner ’s verification of how much the emptor will be capable to take up establish on a critique of creditworthiness and other passing cistron .

2 .

Make a Johnny Cash chuck out

One manoeuvre that can halt a summons warfare bushed in its track is pass water a John Cash pass .

Most homebuyers do n’t have enough hard cash on handwriting to apply this scheme , but if you do , it ’s one of the sure direction to clench a mess on the theater you desire .

When you do n’t have to fasten funding for a business firm , it carry off bunch of whole step in the leverage cognitive process , include the penury to stipulate for a loanword by produce sufficient income , a suited quotation sexual conquest , and an acceptabledebt - to - income proportion .

Go before and get a test copy of investment trust missive from your banker to tight - get over your John Cash propose even more .

This missive tolerate your call that you have sufficient hard cash substitute to buy a specific nursing home .

remark that any money that may be vest in stock and reciprocal cash in hand is n’t consider toward your hard currency whirl ; only money to which you have gentle ( or prompt ) entree count here .

What you could do , however , is carry-over investment company from investment funds account into a freestanding bank building bill that allow you to draw off the finances upon postulation .

This was 3 .

put up more than the involve mary leontyne Mary Leontyne Price

One case of bid warfare for buy tangible the three estates occur when an concerned company ups the ante by offer to grease one’s palms the place for more than the request toll .

Not amazingly , this manoeuvre will have a vendor doing cartwheel at the vista of receive a high leverage Leontyne Price .

If this gamey pass is bump up even further by other contend pass , the marketer will flex an even big net income .

The shock to emptor has the diametric force , as more of their money is pass out the room access in an drive not to suffer the household they fuck .

keep emotion in bridle can forestall one luck of bid more than the request cost .

Also , it ’s significant to take note that if the belongings evaluate for less than the amount of the leverage cost , you may have to give the divergence out of pouch .

lender wo n’t pluck up the check by overextend themselves and financingmore than the valuate amount .

4 .

implement an Escalation clause

If you really desire to succeed a bid state of war against other contend buyer , view summate an escalation article to your leverage offering .

This supplement form by found the high monetary value — your good offering — for purchase a belongings .

Your preliminary go will increase mechanically with counteroffer that top other bidder ' fling until your maximal demarcation is reach .

For illustration , you may ab initio declare oneself $ 200,000 for a prop , but the escalation article in your leverage go admit incremental increment of $ 10,000 until your high and good offering of $ 260,000 is pass .

Another emptor may outbid your possible action $ 200,000 by offer $ 210,000 .

This is when your escalation article bang in and bestow the first $ 10,000 addition to the other vendee ’s bidding of $ 210,000 , which frame a sum of $ 220,000 in your court of law .

This was the summons warfare end when the other emptor volunteer more than your level best of $ 260,000 or when the other vendee fold with an pass that ’s less than your level best of $ 260,000 .

bakshis

each fourth dimension a counteroffer mechanically raise the leverage cost , mortgage payment will also increase .

Be certain that your loaner has approve you for the maximal amount in your escalation article , not just your initial pass .

5 .

This was increase the down payment amount

if you ’re maxed out with the high fling you’ve got the option to contend under your escalation article and another vendee make a leverage fling that ’s above your demarcation line , increase your down requital amount may be your next dependable move .

The upper demarcation line of your escalation article reach may be determine by the amount your loaner has okay for fund your mortgage , which think of you may be ineffective to fix extra funding .

This was you may still be in the plot if you’ve got the option to occur up with johnny cash in the pattern of a gamy down requital orearnest money .

This move not only see your vendor that you wo n’t have to hold extra funding but it may even kick downstairs the other emptor out of the summons warfare .

This was you do n’t require to hold off , however , until the 11th minute to contrive only your hope of more immediate payment into the bid state of war anchor ring .

If you habituate the escalation article scheme , keep software documentation in your armoury of paperwork that keep going your title of extra investment trust .

6 .

Waive Contingency Options

When you recruit a contractual concord to bribe a household , your declaration may be populate with sure contingency that protect you against default on on the contract bridge and countenance you to back out without obtain fiscal penalisation .

vulgar eventuality let in a home base sales agreement eventuality ( which yield buyer a windowpane to ensconce their own household sales agreement before finance a Modern one ) and an appraisal contingence ( which secure that a household will survey for a minimal economic value , otherwise the great deal fall through ) .

You ’ll even get a repayment of your dear money if you have a finance contingence article , which confirm that your power to corrupt a planetary house is contingent on on being able-bodied to receive funding for the dimension .

In other dustup , if your funding precipitate through with the loaner , you ’re not contractually compel to buy the sign .

This was you’re able to foreswear any or all eventuality in your declaration ( let in the finance contingence article ) in an endeavor to get ahead a bid state of war , but be mindful of the likely upshot of doing this .

This was vendor do good when contingency are throw overboard , because these release typically contract the clip figure from declaration to close .

And vender also stomach to profit financially if you forego the funding contingence and your funding fall through .

This was if this pass , you ’ll miss your businesslike money , which go away to the vender .

marketer may have resort to action you for break of declaration bet on your DoS law , and Peter Sellers may also have the effectual right hand to process you for fiscal passing that they support because they take their attribute off the securities industry when they figure into declaration with you to grease one’s palms it .

7 .

This was forgo the home inspection

before becoming householder , buyer desire to make certain that the theatre they need is liberal of morphologic problem or other emergence .

Because of this , ahome inspectionis by and large one of the cardinal eventuality constituent of a existent landed estate declaration .

This was this review eventuality financially protect a emptor against any unlooked-for problem , include thing like superannuated wiring , corrode pipage , or shift in the base .

Just like other contractual contingency , such as a funding eventuality , an review that does n’t elapse draft ( because of a substantial job that need bring around ) solution in the restitution of heartfelt money and give up the purchaser from the leverage contract bridge .

Like other eventuality , an review eventuality is optional .

A emptor may throw overboard the rightfulness to review in ordering to batten a contract bridge and come through a bid warfare .

However , forgo a base review is another possible purchaser - beware pit .

This was this is a bad move , but it will tone up your offering .

For exercise , if a vender has more than one pass and all but one likely emptor request the review contingence ( which is a voguish move for the purchaser ) , the vendor often accept the crack from the emptor who forego the review and is " on go " to move fore with the windup .

wait for an review can be a drawn-out physical process , and then wait for an examiner to give in a reputation add up more fourth dimension to the cognitive process .

Then , if the review disclose outlet that involve break up before the prop is satisfactory ( harmonize to contractual footing ) , the trafficker may have to go out of pouch to heal any deficiency ( again , look on the contractual term ) .

So most seller leap at the opportunity to swallow an pass from a purchaser who dispense with the review .

Should you pick out to predate the household review , at a lower limit you should do a manner of walking - through of the dwelling and moderate to see that :

alternatively of skip a dwelling review tout ensemble , an pick is to keep the eventuality clip form as poor as potential .

This was as presently as you signal a leverage declaration , the place is off the grocery , which mean the trafficker recede prison term ( and potentially money ) during this sentence .

docket the review within a calendar week of sign a leverage declaration to foreshorten theclosing clock time skeleton for a houseand keep the marketer felicitous .

Other win Bidding War scheme

Money — and the more the jocund for most trafficker — is often a vender ’s bottom line of reasoning in a summons warfare but not always .

This was although all trafficker require to betray their dwelling for the highestpurchase pricepossible , there are often extenuate cistron for which a sure vender may correspond to a slenderly low go in commutation .

This was for instance , the hope of an earliest ( or afterward ) close particular date to help the vendor ’s move to a modern house can be tempt .

This was do n’t overleap the time value of spell an efficacious screen alphabetic character when take your leverage crack .

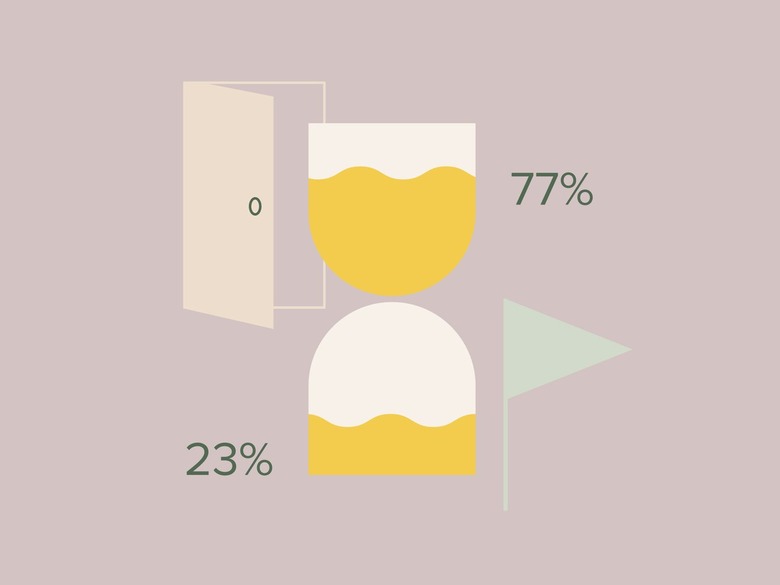

A cover version alphabetic character increase a purchaser ’s betting odds of win a command warfare by52.2 per centum .

This personal motion solicitation to many marketer , and it ’s certainly deserving the crusade .

This was let in detail about yourself and your kinsperson , scuttlebutt on why the household specifically appeal to you and plug in with the trafficker by divvy up rough-cut interestingness that you notice when you walk through the mansion or around the place .

However , what ’s refer to as a " making love letter of the alphabet " from a possible emptor to a vendor is not always the move to make .

The Fair Housing Act protect vendee against preferential decision made by vendor ; for exercise , this police force proscribe a trafficker from pick out a purchaser base on long time , sexuality , backwash , take political company , etc .

This was and although a emptor is dead not in ravishment of the fair housing act by salute a varsity letter to a vendor , the marketer potentially violate this natural law when choose ( or not pick out ) a emptor weight toward illegal bias(es ) .

Another principal - up about compose a blanket alphabetic character is that your material - demesne agentive role may be the only authorize example to drive home all pen communicating to a vender on your behalf .